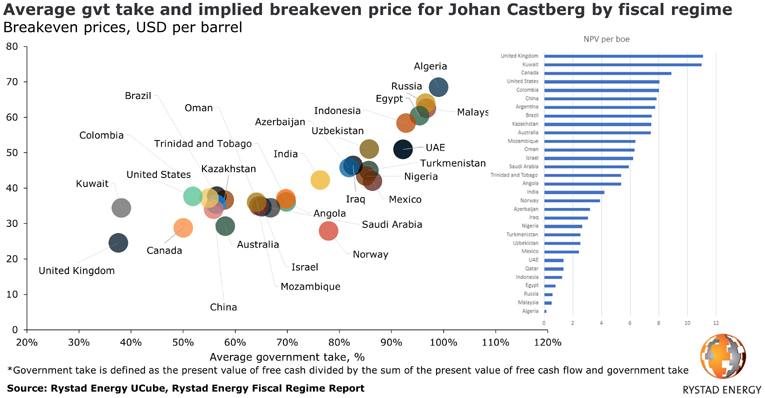

Options and compare their relative positioning in terms of production costs. A comprehensive Rystad Energy analysis of oil production costs has revealed that the average breakeven price for all unsanctioned projects has dropped to around 50 per barrel down around 10 over the last two years and 35 since 2014.

Rystad Energy Oil Production In Canada To Restart Growth Trajectory From 2021

Those findings are from Rystad Energys UCube database which has information from roughly 65000 oil and gas fields around the world.

Rystad energy ucube oil production cost. There are several commercially-available options. A comprehensive Rystad Energy analysis of oil production costs has revealed that the average breakeven price for all unsanctioned projects has dropped to around 50 per barrel down around 10 over the last two years and 35 since 2014. Previously in 2014 Rystad Energy had estimated that the required oil price for producing 100 million barrels per day in 2025 was close to 90 per barrel an estimate which was later revised in 2018 to around 55 per barrel.

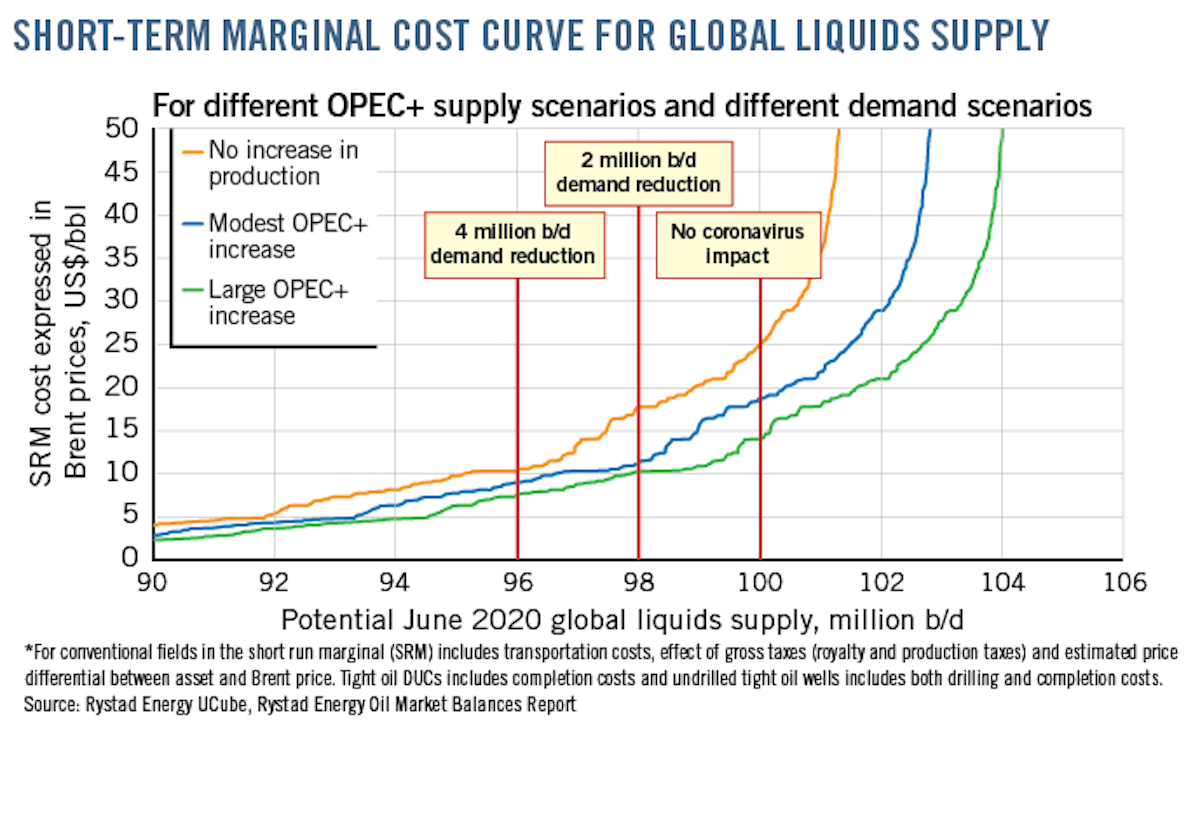

Jan 8th 2020. Rystad Energy estimates that the total demand for liquids will be around 100 million bpd in June 2020 assuming no coronavirus impact. A Rystad Energy analysis aimed at mitigating currency effects confirms this trend after examining regional opex reduction per barrel measured in local currency.

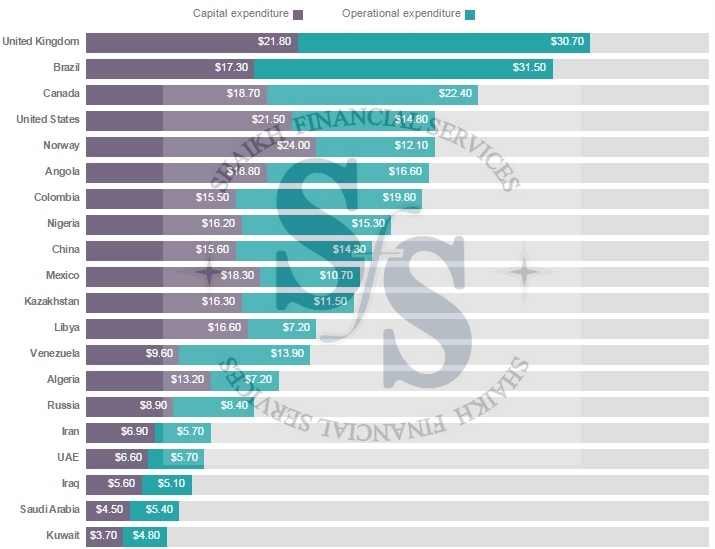

This version has been corrected. In the United States production costs are 36 a barrel -- still below the trading price. Total production with an SRM cost above 15 per barrel is around 4 million bpd.

Oil Gas Upstream Emissions Exploration MA Shale Upstream Economic Model. April 15 2016 Source. The average Brent breakeven price for tight oil is now estimated at 46 per barrel just four dollars behind the giant onshore fields in Saudi Arabia and other Middle Eastern countries.

Operational production costs in the oil and gas industry have fallen across the globe with UK emerging as a cost-cutting powerhouse among global offshore regions. Before COVID-19 oil and gas taxes usually exceeded the trillion-dollar mark. This means that oil is much cheaper to produce now compared to six years ago with the clear cost savings winner being new.

Operational production costs in the oil and gas industry have fallen across the globe with the United Kingdom emerging as a cost-cutting powerhouse among global offshore regions. Rystad Energys base-case price scenario assumes a 30 WTI oil price for 2020 with prices rising to an average of 39 for 2021. State income from oil and gas taxing Energy transition risks for petrostates source.

Rystad Energy UCube The global government income from oil and gas taxation fell to a multi-year low in 2020 of around USD 560 billion as production and prices shrunk. An earlier version of this graphic displayed incorrect labels for the cost to produce a barrel of oil when hovering over the bars on each chart. A comprehensive Rystad Energy analysis of oil production costs has revealed that the average breakeven price for all unsanctioned projects has dropped to around 50 per barrel down around 10 over the last two years.

We are headquartered in Oslo Norway with offices across the globe. Of course its hard to make money when the cost of producing oil is. Our products and services cover energy fundamentals and the global and regional upstream oilfield services and renewable energy industries tailored to analysts managers and executives alike.

The results are clear from 2014 to 2018 the UK. This means that oil is much cheaper to produce now compared to six years ago with the clear cost savings winner being new offshore deepwater. The Carbon Tracker Initiative has used Rystad Energys UCube2 database for oil.

The database should be reputable and reasonably comprehensive for the required purpose. In 2015 North American shale ranked as the second most expensive resource according to Rystad Energys global liquids cost curve with an average breakeven price of 68 per barrel. Despite a gradual output increase monthly production is expected to only touch 117 million bbld at.

October 21 2020. The updated curve also shows another key trend. Rystad Energy is an independent energy research and business intelligence company providing data analytics and consultancy services to clients exposed to the energy industry across the globe.

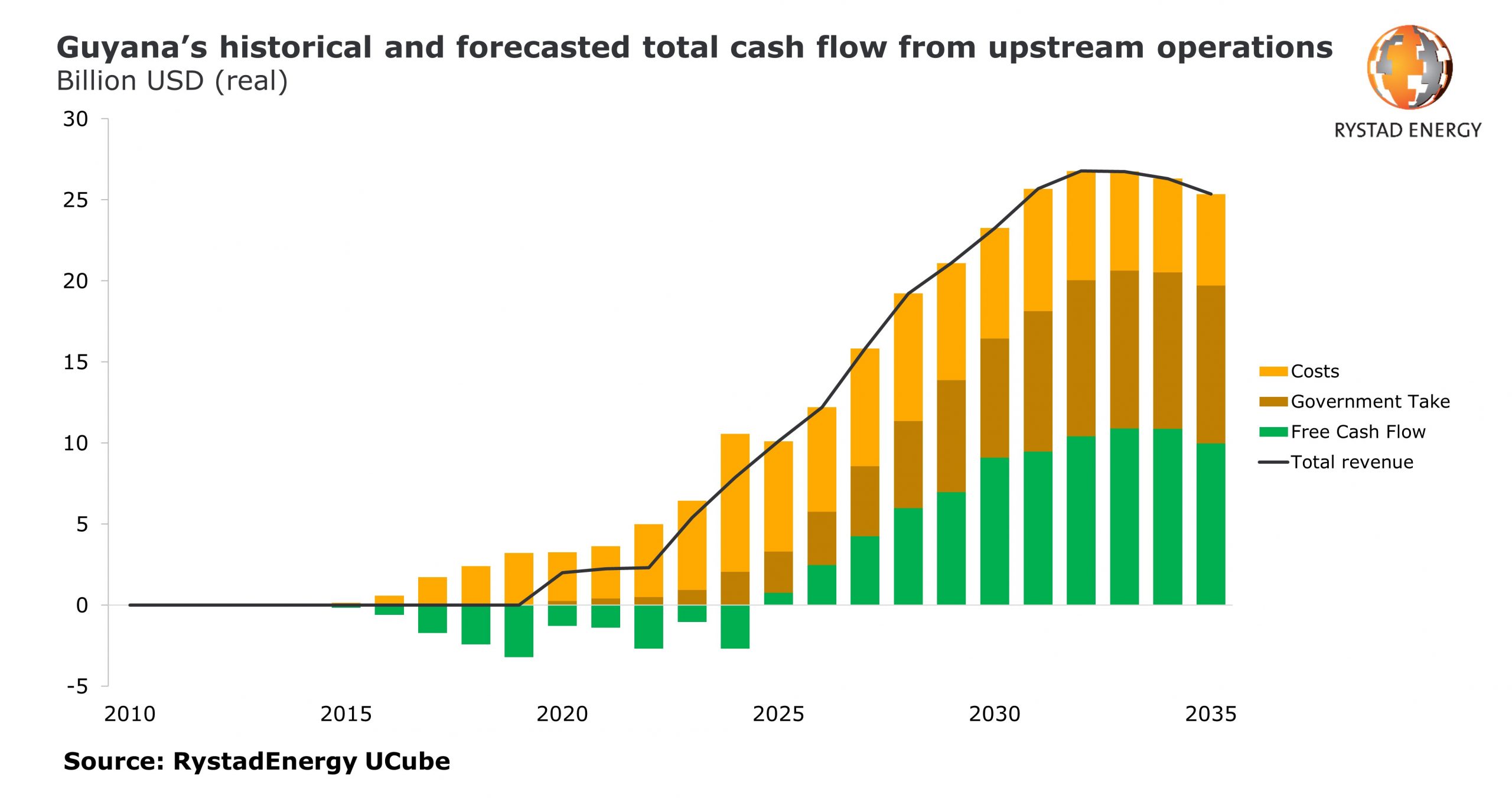

Get full visibility into the global oil and gas industry Through topical and fact-based analytics highly detailed data and leading-edge advisory services Rystad Energy is uniquely positioned to provide deep insight into the global supply of oil and gas investment trends portfolio valuation portfolio benchmarking and transaction analyses. The cost of supply curve moves to the right if OPEC increases production. Rystad Energy forecasts that Guyanas oil production could reach 12 million barrels per day by the end of the decade lifting total annual oil revenues to about 28 billion assuming an oil price of about 65 per barrel.

Get the latest news and events from Rystad Energy. Get the latest news and events from Rystad Energy. Rystad Energy AS Fjordalléen 16 Oslo 0250 Norway.

A Rystad Energy. Next year will not be the year of salvation. Oil production in Brazil costs nearly 49 per barrel.

Production costs around 41 a barrel in Canada. About us Leadership People Careers Why us Contact Us. Supply Chain Battery Materials Emerging Services Offshore Wind Global Service Market Cost Prices Subsea Rigs Vessels Wells Energy Metals North American Completion Services Seismic Surface Facilities.

Rystad Energy is an independent oil and gas consulting services and business intelligence data firm offering global databases strategy consulting and research products.

Rystad Energy Us Shale Growth Could Once Again Pave The Way To An Oversupplied Market

Oil Production Cost Country Wise Shaikh Financial Services

Rystad Energy Opec Oil Production To Decline By 2 7 Million Bpd In 2020 As A Result Of New Opec Agreement

Rystad Energy On Twitter Costs Within The Upstream Industry Have Decreased Significantly How Lower Costs Impact The Market And Which Supply Sources Are Benefiting The Most Find Out In Our Free Report

Rystad Energy Ranks The Cheapest Sources Of Supply In The Oil Industry Energy News Energy Bunker Ports News Worldwide

Rystad Energy Oil Production In Canada To Restart Growth Trajectory From 2021

20 Oil Not Far Off As Opec If Unleashes 2 5 Million Extra Bpd Energy Northern Perspective

Http Theoilage Org Wp Content Uploads 2018 06 Article 16 Pdf

Oil Production Is Going To Drop And Oil Prices Are Likely To Increase Seeking Alpha

Rystad Energy 20 Bbl Oil Not Far Off Oil Gas Journal

Offshore Deepwater Oil Production One Of Cheapest Sources Of New Supply As Costs Reach New Low Rystad Says Brazil Energy Insight

Us Presidents And Oil Production A Deep Dive Into Obama And Trump Records Biden S Proposed Plan Energy Northern Perspective

Rystad Energy Us Shale Growth Could Once Again Pave The Way To An Oversupplied Market

Guyana S Total Annual Oil Revenues Could Approach Us 30b In 10 Years Rystad Energy Stabroek News

Rystad Energy Covid 19 May Forever Spoil Angola S Plans To Rebuild Its Declining Oil Production Oilfield Technology

Rystad Energy Ranks The Least Expensive Sources Of Supply In The Oil Industry Energy Northern Perspective

Oil Production Costs Reach New Lows Making Deepwater One Of The Cheapest Sources Of Novel Supply Energy Northern Perspective

Rystad Energy Us Shale Growth Could Once Again Pave The Way To An Oversupplied Market